The Wall Street Journal had an article today with some rather spurious claims and a nasty-looking graph. They throw in some insults and some conjecture as well as the misleading headline,"Obama's Tax Evasion". Check it out here.

Perhaps a quick overview of the Capital Gains tax is in order (from Wikipedia)

Capital gains are separated into two categories: Short and Long term. Short term rates are applied at the investors normal income rate (that is, your income tax rate), and long term rates are applied at a lower rate. The gains tax applies to any nominal gain (profit from the sale of) any capital (debt, equities, and real). The tax only applied to realized gains.

You can see the Tax Rates for all incomes here.

So, what exactly does the WSJ claim about the Cap Gains tax?

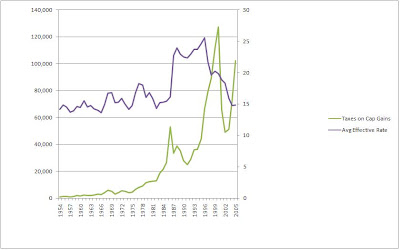

1. The effective rate, the rate derived by dividing the total capital gains by the taxes raised on capital gains, is inversely related to the Capital gains tax realizations a percentage of GDP.

2. The claim is that Capital Gains tax income is a function of the effective rate; a decrease in the capital gains effective rate (at all levels) increases the tax realizations and a decrease in the capital gains tax rate (at all levels) increase tax realizations.

3. Lifting the effective rate for those in the top substrate (the "capital gains tax rate") would decrease realizations.

So the point is - if the top rate, the capital gains realizations increase.

Let's take a look at how the effective rate is derived and how it differs from the capital gains tax. The effective rate is the taxes paid on capital gains divided by the total amount of capital gains in a given year.

Taking what we know about the structure of the tax code - long and short term capital gains - we can develop some sort of model.

I suggest that what is actually happening in this picture is much different from what is suggested, and that the likely relationship is between capital gains and realizations.

The effective rate is determined by which income substrates are making capital gains, not by government policy, which sets substrates and set the upper limit. The effective rate does move from year to year and is a more accurate depiction of what's happening.

What can make the effective rate change?

1. Increases in the top rate, making high-income investors pay more.

2. A change in which income substrate is paying the gains tax.

So here are two possible other relationships and explanations which fly in the face of this relationship the WSJ claims to be true but does not explain. For their claim to be true, there needs to be a causal negative relationship between high maximum tax rates and taxes paid on capital gains.

Economists don't favor McCain's policies. He has called for unrealistic budget and tax cuts. We need sound policy, better trade negotiations, and an end to the open financial commitment in Iraq. We will always have ups and downs, but sound policy will cement growth in the U.S. for years to come. Unfortunately, fiery rhetoric from conservative papers doesn't add much to the debate - or to the nation.

4.18.2008

Wall Street Journal calls Obama "Wrong on Taxes" : Analysis

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment